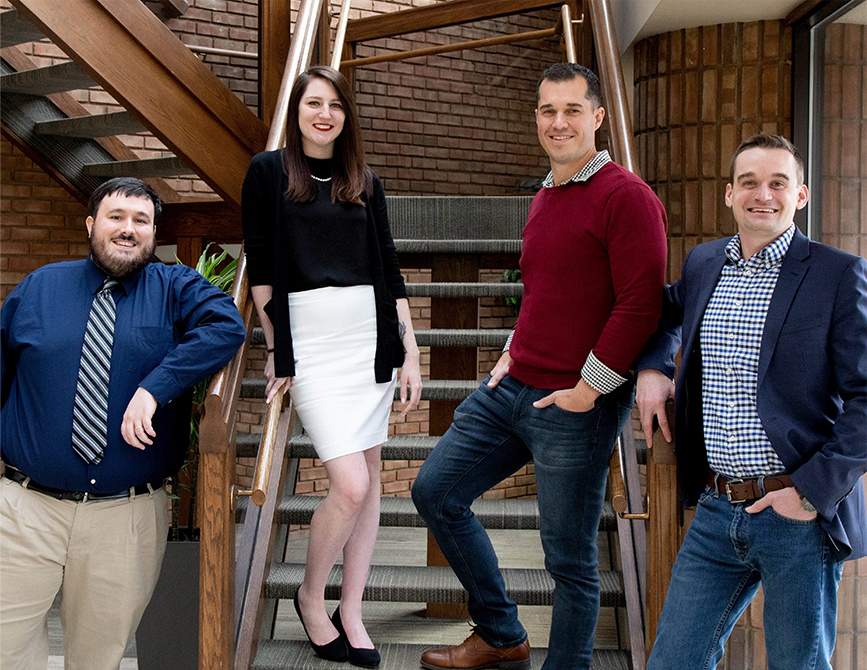

Our team of Attorneys all specialize in bankruptcy and are ready for any issue you may have.

Grand Rapids’ $1,200 Flat-fee Bankruptcy Law Firm

If you are having financial troubles, you may be considering consulting with a bankruptcy law firm. The process can be complicated, and you need an experienced legal professional on your side who will help you make informed decisions as you navigate your options in bankruptcy. More importantly, if you are in a situation in which you are considering bankruptcy, you will need a lawyer that can assist you at a reasonable price.

Frequently Asked Questions

Schedule a Free Consultation

Considering filing for Ch 7 or Ch 13 Bankruptcy? Consult with our firm today.

Types of Bankruptcy

The Bankruptcy Code is divided into chapters. The chapters which usually apply to consumer debtors are chapter 7, known as a Fresh Start,

and chapter 13, known as a Repayment Plan.

Chapter 7

“Fresh Start”

With a “fresh start,” the debtor will be discharged from the legal obligation to pay unsecured debts such as credit card debts, medical bills, cash-advances and utility arrears. However, certain types of unsecured debt are allowed special treatment and cannot be discharged. These

include student loans, alimony, child support, criminal fines, and some taxes.

Chapter 13

“Repayment Plan”

A chapter 13 case may be advantageous in that the debtor is allowed to get caught up on mortgages or car

loans without the threat of foreclosure or repossession and is allowed to keep both exempt and nonexempt property. Additionally, the debtor

may strip a second mortgage or even reduce the interest rate on existing secured loans, such as a vehicle loan (down to 4.5%).

Areas of Practice

The Bankruptcy Code is divided into chapters. The chapters which usually apply to consumer debtors are chapter 7, known as a Fresh Start, and chapter 13, known as a Repayment Plan.

“Best attorney

I have ever met.”

After my divorce I had to file for bankruptcy and was very embarrassed and ashamed. However, from the moment that I walked through the door at Russell Law Firm I felt comfortable and was treated with dignity and respect. Everyone was very helpful and the process was very easy. My questions were always answered quickly and everyone was always very kind and pleasant to deal with. No one ever wants to be in this situation but if you are I would highly recommend this firm! I can not say enough good things about them.

I would certainly recommend this firm to anyone seeking to file bankruptcy. We discussed options. From start to finish, the team was informative, responsive, professional, thorough, and pleasant. Im grateful that I had this knowledgeable firm to work with. I was never made to feel embarrassed or ashamed for my need to file bankruptcy. Many thanks for my fresh new start!

Very nice and friendly staff to work with , answered all my questions quickly and the whole process was easy and completed in a timely manner. I would highly recommend this business if you need help.

Russell Law Firm made one of the hardest things I have had to do way easier than expected. Jacob was very helpful and was able to answer all of the questions I had. They were to help every step of the way and would recommend them to anyone who is filing for bankruptcy.

I highly recommend anyone going through the bankruptcy process in this area to use this firm. They were kind, professional, very clear on the process and helped to answer all of my questions. I primarily worked with Jacob who helped to relieve my fears and I’ve come out better for having gone through this.

At the very least take advantage of the consultation process to see what’s right for you. They’re very understanding!